Bank Branches Go Newer and Smaller

Sources:

Brannon Broswell, ICSC

Branch Banking 2020, JLL Research Report

Big banks are closing antiquated branches at a record pace, but they are also opening smaller and more digitally focused ones to better serve their customers, according to research from JLL’s Branch Banking 2020. After peaking at 100,000 branches in 2009, the number of bank branches has plunged by 13,200.

- Branch bank consolidation continues, 3,164 branches closed last year.

- The biggest institutions are closing the most branches, the 25 largest banks closed 1,777 branches.

- Even as branches close, deposits are growing. The amount of money deposited at branches grew 1.4% last year to $12.8 trillion.

- Banks are still branching out. The 25 largest banks accounted for a fifth of the 1,481 branches added in 2019, and regional and community banks opened the rest.

- Branches are getting smaller, most new branches measure 2,000 to 3,500 square feet, significantly less than the 5,000-7,000 square foot branches of the past.

Last year we identified a revolution taking place in branch banking…

A year later, institutions are still decommissioning branches at a record pace, as well as opening new ones to better serve their customers. While the ideal branch is now smaller and more digitally focused, this industry shift is taking place incrementally due to the large number of existing branches across all markets.

Additionally, the shift toward a digital-only customer experience is gaining steam, but it is not complete, at least not yet. For example, the Financial Brand recently reported that 90% of consumers are comfortable with fintech options for real-time payments and a variety of mobile wallets. On the other hand, they also reported that 93% of consumers only “trust” big banks, community banks and credit unions with their financial data. As such, it is not clear who will be the winners in this competition for the consumer.

At this juncture, traditional banks are being challenged on several fronts to maintain their customer base. They must optimize branch availability to meet the physical need for convenience. They need digital solutions for banking anywhere and anytime, and they need user-friendly apps to make on-the-go transactions easy and seamless. They must also maintain a level of personal engagement to answer any financial questions clients may have. It is not easy to excel at every stage of this customer journey, but traditional banks are still at the forefront and working to address these challenges.

Branch banking consolidation continues, with no slowdown in sight.

Last year, banks continued to pare down their networks at a predictable pace. During FY 2019, another 1,700 branches closed. This 1.9% decline is consistent with our forecast of 2% annual net closures. After peaking in 2009 at close to 100,000 branches, the total number has declined by more than 13,000 branches over a decade. We do not expect this pace to change materially over the next two years as the industry works to integrate physical branches with digital platforms and define how to best serve rapidly shifting customer expectations.

The largest institutions are closing branches even faster.

In our report last year, we noted that the largest institutions had doubled their pace of closings, from 632 in 2016 to almost 1,250 in 2018. In 2019, the top 25 banks closed even more, with 1,450 branches shuttered, reflecting a 3.7% net decline in branches. This faster pace was also mirrored for the top 10 institutions.

Fewer branches, but more deposits.

In 2019, branch deposits continued their upward trend, growing 4.1% to $12.8 trillion. As in past years, banks have been driving higher deposits into fewer branches. During this economic cycle, the FDIC reported that deposits have grown $5.2 trillion, an increase of 68% since 2009. After accounting for the more than 13,000 branches shuttered since 2009, the average branch in the U.S. has seen its deposits almost double, to $148 million. The implication for banks as we move through the late stages of this economic expansion is that the competition to maintain or increase deposits and market share will become keener. This will necessitate that banks, more than ever, proactively manage their networks and focus on location optimization.

New branches are still opening. Old branches are aging.

While the industry tends to focus on “net closures,” this metric can be misleading. Banks are not retrenching. Rather, because of the sheer scale of their networks across the U.S., combined with past M&A activity, banks are still in the early to mid-stage of optimizing their platforms to reflect customer demands and the digital transformation underway. Underscoring this challenge, FDIC information shows that 76% of all branches in operation are more than 15 years old. Although many of these 66,000 banks are in excellent locations, many of them are outdated in terms of their size, technology and facility efficiency.

To modernize their networks, banks opened almost 1,500 branches in the U.S. in the last year. Similar to our prior findings, the top 25 institutions added a fifth of the new (de novo) branches. That means that much of the new development is taking place in regional and community institutions, whose smaller networks allowed them to be more nimble, as they expand selectively to address customer needs and work to maintain or enhance market share.

Not every bank is adapting at the same pace.

As JLL reviewed the most recent new branch openings, we found a variety of development prototypes. Some institutions are still working under the traditional hub-and-spoke system of past years. In this development model, smaller branches are positioned around a larger, full-service hub. In some cases, banks are adding more smaller spoke branches or moving to a very limited-service or even virtual offices in these spokes. In contrast, full-service hubs are becoming more elaborate.

This, however, all depends on the scale of the local market, the institution’s competitive presence, a suburban or urban format, and area density, as well as the particular institution’s growth strategy. This means that branches can take on many “shapes.” The newest branches can range from under 1,000 SF to 10,000 SF or more. In addition, if it is a de novo branch taking over a former outparcel or endcap branch, the physical space is already defined. Overall, we have seen the best modern branches designed to a size of 2,000 SF to 3,500 SF to accommodate a full-service operation but within an efficient overall footprint. This is in contrast to the 5,000 to 7,000 SF branches of the past.

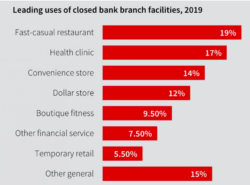

So what’s happening to the closed branches?

When a bank branch does close, landlords have plenty of options for refilling the space, JLL says. Competing banks and financial institutions often snap up well-located suburban facilities. And in-line spaces are often repurposed as restaurants, convenience stores and clinics. On average, the time period for selling a vacated branch is about nine and a half months, and the average time for subleasing is slightly over a year, according to JLL.