Cost Segregation Studies Generate a Lot of Cash for Real Estate Investors

By Cliff Hockley, President of Bluestone and Hockley Real Estate Services

Executive Director, SVN | Bluestone and Hockley

Cost segregation studies are a very effective way to shelter investment property. They should be considered by every real estate investor on every transaction. When optimized, they can increase cash flows, reduce tax liability and uncover missed deductions. Thanks to the Tax Cuts and Jobs Act of 2017, the benefits are still very favorable.

What is a Cost Segregation Study?

A cost segregation study (CSS) is a tool that real estate owners and investors can use to improve their tax positions. The study dissects the construction costs or purchase price of the property into its component parts and then depreciates the parts using shorter depreciation lives.

Depreciation definition: Tax depreciation is the depreciation that can be listed as an expense on a tax return for a given reporting period under the applicable tax laws. It is used by building owners to reduce the amount of taxable income reported. Depreciation is the gradual charging to expense of a fixed asset’s cost over its useful life. The IRS allows 15 years of depreciation for gas stations, 27 ½ years for apartments, and 39 years for commercial buildings. Land is typically not depreciated, just buildings.

By segregating personal property from the building, itself, cost segregation studies reassign costs that would have been depreciated over a 27 ½ or 39-year period to asset groups that will be depreciated at a much quicker pace such as 5,7 or 15 years, or perhaps even expensed immediately due to 100% bonus depreciation opportunities.

What are the Benefits of Cost Segregation?

- Cash Flow: The Study generates an immediate increase in cash flow through accelerated depreciation tax deductions.

- Write off: Quantifies property’s major components and leasehold improvements so they can be written off when replaced or renovated.

- Bonus Depreciation: Performing a cost segregation study will now have a stronger impact. Any assets that are removed from the “real property” bucket and placed in the “personal property” bucket may now be eligible for bonus depreciation and can be immediately expensed in the first year.

Consider the following example:

A taxpayer purchases a building worth $10 million. After performing a cost segregation study, they can reclassify 10 percent of those costs to be personal property. By assigning these assets a shorter depreciable life, they can apply bonus depreciation and write off $1 million of that $10 million purchase price in Year 1. A taxpayer with a 25 percent marginal tax rate would save $250,000 in taxes, or 2.5 percent of the purchase price, that first year.” (*1)

A Force to be Reckoned With

The 2017 tax reform package made two simple changes – both to bonus depreciation – that make cost segregation studies very valuable.

- Bonus depreciation allows individuals and businesses to immediately deduct a certain percentage of their asset costs the first year they are placed in service.

- The tax law made used property as compared to new property, eligible for bonus treatment for the very first time, and it also increased the bonus depreciation percentage to 100 percent through tax year 2022. Prior to this law change, only new property was qualifying, and Bonus Depreciation was expected to be only 50 percent in 2019.” (*1)

Sell, Hold, Refinance, 1031 Exchange

You are ready to exit your investment. Does the CSS create a negative impact for you taxwise?

- If you sell the property for cash, you may need to reimburse the government (they call it recapture), 25% of the deprecation you have taken. It would be prudent for you to have planned out your sale costs (i.e., taxes) with your CPA and your Cost Segregation Professional long before you sell.

- If you hold and/or refinance, there is no impact since they are not taxable events (like a sale).

- If you chose to use a 1031 exchange, generally, no gain or loss is recognized for taxpayers that exchange business or investment property solely for business or investment property of a like-kind under Sec. 1031; nevertheless, recapture tax may be required even when there is an even exchange of real estate except on the 1250 Section: Real Property (Structural Elements)

- However, when a Cost-Segregation Study is performed on a relinquished property, Sec. 1245 (Personal property) recapture tax can be avoided as long as there are equal amounts or more Sec. 1245 property in the newly acquired replacement property. This often requires a Cost Segregation Study on the newly acquired property, to avoid surprises after it is complete, and often depends how long you have owned the relinquished property in service. 1245 personal property recapture is recognized at ordinary tax rates.

- To transfer property that has been allocated to 5-year, 7-year, 15-year, & 39-year, the new property must also have a cost segregation with equal or greater allocations. If the property has been held for a decade or more, it may be advantageous to allocate a large percentage of the sale to the 1250 (personal) property and only exchange that amount.

The 2020 CARES Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on March 27, 2020. There are numerous cost segregation-related provisions included in this $2 trillion+ Aid package, but two stick out for taxpayers who own real estate (including leasehold interests) as most impactful: The Qualified Improvement Property (QIP) Rule and Net Operating Loss (NOL) carryback.

Qualified Improvement Property (QIP) Rule:

This rule states any capital spending from 2018 to 2022 can immediately be expensed with certain exceptions (see below).

The Tax Cuts and Jobs Act (TCJA), passed in late 2017, made several changes to how leasehold improvements, retail, and restaurant property were accounted for by eliminating specialty rules and grouping owner-occupied non-structural improvements as “Qualified Improvement Property” (QIP). However, the class life of QIP from January 1, 2018 and onward was overlooked and not assigned a 15-year depreciation period, making such improvements ineligible for bonus depreciation.

This was corrected in the CARES Act and now any owner, lessee, retail or restaurant owner with any qualified building capital spend from 2018 to 2022 can immediately write-off the costs. Improvements can now, and retroactively to January 1, 2018, have a 15-year tax-depreciable life making them subject to the 100% bonus depreciation rules.

To illustrate this, let’s assume a $5 million tenant Improvement or build-out. Prior to the CARES Act, the annual write-off would be $128,200 for 39 years. Under the new rules, the entire $5 million can be written off in the same year.

Key Considerations

- QIP does not include the following improvements:

- An enlargement of the building,

- Work on elevators or escalators,

- Some categories of work on the structural framework of the building (e.g., an internal staircase modifying a structural framework).

- Taxpayers with projects that meet the QIP definition would need to amend their previous tax returns to take advantage of the new QIP rules on a look-back basis. However, if a return has not yet been filed, taxpayers may need to adjust their cost segregation report.

Net Operating Loss (NOL) Carryback

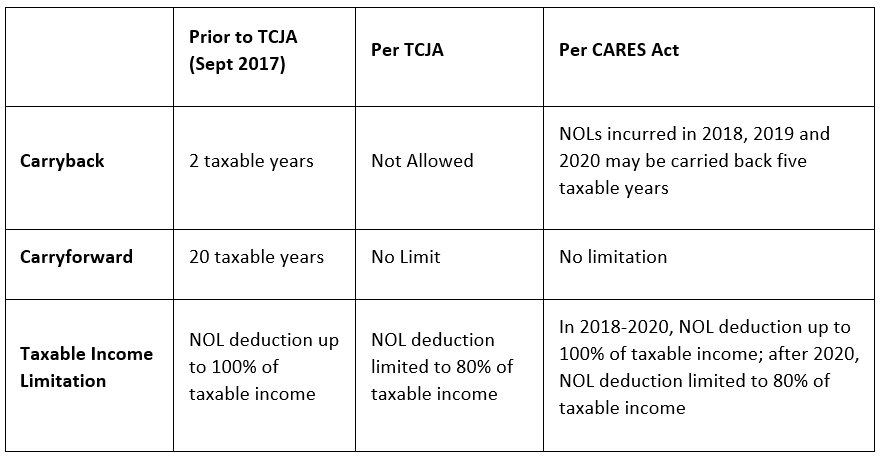

This rule allows real estate owners to offset taxable income to reduce their tax liability. NOLs incurred in 2018, 2019 and 2020 may be carried back five tax years.

A Net Operating Loss (NOL) occurs when a business’s operating expenses exceed its revenues. NOLs can often be used in tax reporting as an offset to taxable income, reducing tax liability. The CARES Act has modified the NOL carryback rules for taxpayers enacted as part of the TCJA.

The following illustrates impacts of the NOL Carryback Rule prior to Sept 2017, after TCJA and now, after the CARES Act:

Summary

Our clients have successfully used Cost segregation studies to accelerate their depreciation and increase their cash flow. It is an investment tool that can be used over and over again and may motivate an educated investor to purchase more properties, thereby increasing their net worth and enabling them to continue accelerating their property purchases. This tool works well for all real estate investors. Cost segregation experts can help real estate owners explore these provisions to find ways to recover from financial setbacks resulting from COVID-19.

Finally, a note of caution, cost segregation studies are not recommended for owners of investment homes that they may decide to move into. When they move in, a large, unexpected tax bill might be incurred.

The author wants to thank Jonathan Frizzell, 206.399.7769, jfrizzell@shstrategies.com, Cost Segregation Consultant for his review and input into this article.

Sources:

- (*1) https://www.accountingtoday.com/opinion/tax-reform-makes-cost-segregation-even-more-beneficial

- https://www.thetaxadviser.com/newsletters/2016/aug/avoiding-cost-segregation-recapture-tax.html

- https://rcgvaluation.com/perspectives/cost-segregation-the-calculation-of-asset-recapture-regulations