Goldman Sachs Economist Predicts “there’s a 60% chance that the economic recovery goes on for another 4 years.”

Goldman Sachs economist predicts “there’s a 60% chance that the economic recovery goes on for another 4 years.” This means that the current recovery period will continue until 2019.

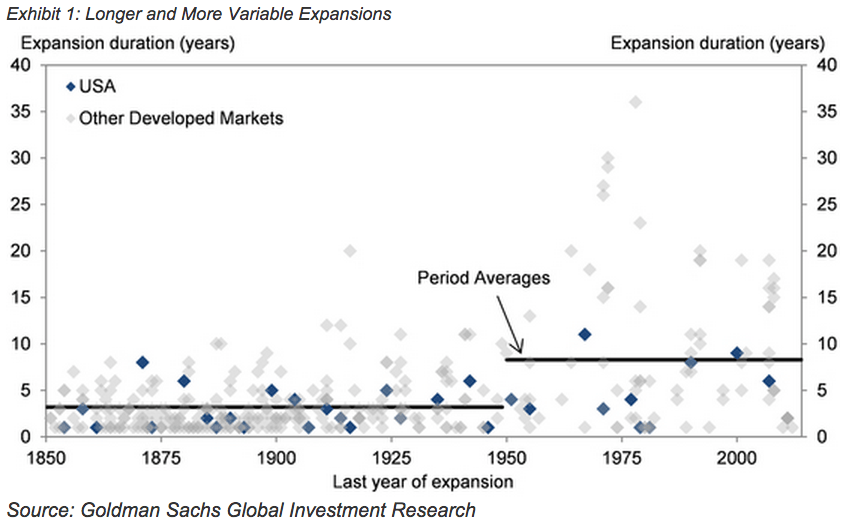

The current recovery period that started in 2009 is already one of the longest ever. According to the National Bureau of Economic Research, “this recovery period is nearly twice as long as the average age of expansion since 1854.”

Goldman Sachs economist Zach Pandl explained that:

“When an expansion is just starting out, the odds that it will last more than six years — i.e. beyond the life the current US expansion — are only about 45%, based on data since 1950. However, the “mortality rate” of business cycles is fairly steady from one year to the next, with only a slight tendency to increase over time. Therefore, conditional on an expansion reaching six years of age, the odds that it can continue are still reasonably good. Again using data since 1950, we calculate that the unconditional odds that a six-year-old expansion will avoid recession for another four years—and mature into a 10-year-old expansion—are about 60%.

It’s important to stress that these figures represent unconditional probabilities—the equivalent of life expectancies without regard to physical health. That being said, we see the historical record as mildly encouraging, and the message broadly aligns with our judgmental view—we would put the odds of recession over the next year at about 10-15%. Although there are clearly some risks to the US economy—especially from developments abroad—we do not expect the expansion to expire of old age.”

Again, it should be noted that Zach Pandl’s forecast is based on historical trends and not of the current economic conditions. However, if history holds up, we can expect a four more years of economic growth ahead.