Investing in Multi-family commercial real estate? Learn how the market performed in 2019!

2019 Multi-family Market Report

Overview

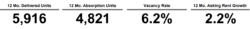

Portland metro is in the midst of a massive apartment construction wave, but the continued influx of well-educated young professionals mitigates concerns about supply-side pressures. Though the annual population growth has declined over the past two years, local growth still far exceeds the national rate, with many incoming residents choosing Portland over more expensive West Coast metros. Absorption has largely kept pace with new deliveries. Simultaneously, rent growth – though still far below the levels seen a few years ago – is in line with the historic average. Robust sales volume exceeded $2 billion in the past 12 months, thanks to the strong presence of institutional and value-add investors.

In February 2019, Oregon became the first state to cap annual rent growth, the law also placing severe restrictions on evicting tenants without cause. In the wake of this high-profile new legislation, investment on both sides of the Columbia River is seeing some volatility. The rent cap builds on similar legislation enacted by the Portland City Council over the preceding three years, aimed at curbing rent growth and increasing the availability of affordable housing.

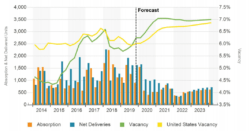

Vacancy

About 12,000 apartments have delivered in the past two years, representing around 6% of Portland’s total apartment inventory. However, absorption has largely kept up with the new supply, as regional demand continues to benefit from strong local economic and population growth. The Portland region added 15,900 jobs over the last 12 months. That puts Portland on track to add 253,000 jobs this decade. However, the pace of job growth is clearly slowing. From 203 through 2017, Portland averaged about 31,000 new jobs a year.

While demand is strong from highly paid employees, not everyone works for Nike or a tech company downtown. Due to strong cumulative rent growth coming out of the recession, affordability has become a major concern for many Portlanders. In October 2015, when metro rent growth peaked, the Portland City Council declared a housing emergency. This declaration has since been renewed several times, including in February 2019 for another two years. Ensuing regulation is primarily aimed to curb rent growth and increase the affordable housing inventory, and Oregon’s newly enacted statewide rent growth cap addresses similar concerns. In addition, the city council unanimously approved an inclusionary zoning policy, enacted in February 2017, which requires apartment and condo developers with projects larger than 20 units to reserve 20% of apartments for households making less than 80% of the median income. In January 2019, the executive director of Prosper Portland cited inclusionary zoning as contributing to the failure of the proposed 33-acre South Waterfront development.

Downtown Portland remains a popular submarket due to its walkability and entertainment options. However, the re-emergence of the South Waterfront has boosted demand in Southwest Portland, especially with continued expansion at Oregon Health and Science University. Eastside neighborhoods provide more-affordable alternatives for renters interested in an urban lifestyle but priced out of Downtown. Many of the submarket’s neighborhoods are quickly gentrifying, providing young professionals with trendy living options at prices they can afford. Western suburbs like Hillsboro and Beaverton continue to benefit from the presence of Intel and Nike, among the metro’s largest employers, but they also present certain risks to apartment demand. In particular, when Intel and Nike both announced substantial layoffs in 2017, already-elevated apartment vacancies spiked in Hillsboro.

Homeownership remains out of reach for most renters. Though the formerly inexorable rise of Portland’s median home price has flattened in 2019, the local median price remains well above the national figure. Portland’s homeownership rate appears to have stabilized in the low-60% range. Despite the recent expansion of the Urban Growth Boundary, new single-family residential construction is limited, especially in areas with access to an urban lifestyle. People searching for suburban properties will find a shortage of affordable, well-located homes.

Absorption, Net Deliveries & Vacancy

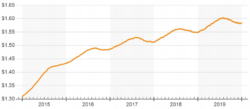

Rent

Despite a slight dip in the second half of 2019, apartment rent growth in Portland has been slowly but steadily ticking upward. Still, current gains mark a decline from notably high increases earlier in the cycle. For the past several years, rent growth in Portland has been tempered by escalating levels of supply, which peaked in 2018. In February 2019, the State of Oregon capped annual rent increases at 7% plus inflation for assets 15 years old or older, and ongoing legislative efforts by the Portland City Council also held rent growth down. Since January 2010, the typical rent for a market-rate Portland apartment has increased by 41%. By comparison, national rent growth was 30% over this period, though rent growth in Seattle was 47%. Portland’s flourishing regional economy and a reputation for a high quality of life have contributed to the metro’s strong cyclical rent growth.

Downtown Portland offers Portland’s highest asking rents, over $1,800/month. However, cumulative rent growth for Downtown Portland apartments this cycle, at 16%, is less than half that of the overall metro’s increase. In two other submarkets with large construction pipelines—Northwest Portland and Southeast Portland—annual rent growth is substantially below the metro’s average. Hillsboro, among Portland’s priciest suburban submarkets, exhibits some of Portland’s strongest annual rent growth. Vancouver also posts substantial annual gains despite having the greatest inventory of any submarket, with about 29,000 units.

Largely in response to the blockbuster rent growth of 2015, when Portland’s rent growth ranked among the highest in the nation, the Portland City Council declared a housing emergency and has since passed new policies and regulations aimed at reducing rent growth and increasing the number of affordable housing units. Beginning in February 2017, landlords processing nocause evictions, or those whose tenants vacate after a 10% annual rent increase, are required to pay departing tenants $2,900 to $4,500 in relocation costs. In October 2015, landlords became prohibited from raising rents by more than 5% without 90 days’ written notice. Collectively, these changes may prompt developers and investors to proceed with greater caution when considering large rent increases in Portland.