Office Market Report: 2019

Overview

Portland’s strong economy is spurring demand for the metro’s office market. Though deliveries have slowed in 2019, new supply reached a cycle peak the prior year, with 1.8 million SF delivered. More than 2 million SF has been actively under construction since the end of 2016. Much of the ongoing development is build-to-suit, primarily campus expansions for Nike, Adidas, and NW Natural.

So far, vacancies have held up under the supply wave, remaining far below the long-term average. After moderating over the past few years, rent growth is now comparable to national performance, as well as the metro’s historical average.

Portland has seen exceptionally strong office investment in the current year, and annual sales volume has rounded to $1.25 billion or higher each of the past five years. Office properties here sell at lower prices than comparable assets situated in alternative West Coast metros, including San Jose, San Francisco, and nearby Seattle, making Portland an appealing choice for investors.

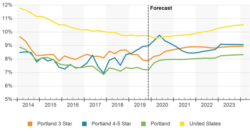

Leasing Vacancy Rate

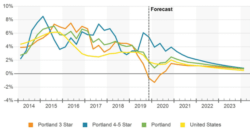

Rent

Portland rent growth is comparable to both the metro’s historical average and to national performance. After peaking at over 6.5% growth at the end of 2016, Portland’s year-over-year office rent gains have markedly decelerated. Still, annual rent growth has been positive for 30 consecutive quarters. Relatively strong vacancy performance has contributed to sizable cumulative rent growth in Stumptown over the cycle, with total rent gains at around 33% since the start of 2010. Performance for higher-end office space has exceeded the average, doing particularly well in the past few years. In the short term, Portland office rent growth is forecast to further compress but generally remain above national performance.

Some growth can be attributed to top-dollar leases in creative office and restored historic buildings. For example, in June 2019, the renovated 1010 Flanders building signed construction firm Skanska for a 21,000 SF lease. The asking rate was $42/SF FSG. In May 2019, law firm Bullivant Houser Bailey PC leased 18,000 SF at Umpqua Bank Plaza at a $38/SF FSG asking rate. The prior year, the Power + Light building signed two large leases for spaces each asking $38.50/SF FSG: Geosyntec Consultants leased 16,000 SF, and Coinbase took 32,000 SF. While all these leases were signed in the CBD, the submarket featuring Portland’s highest asking rents, the CBD’s annual rent growth is generally below the metro’s average.