Potential Danger in the Promised Land

By: Clifford A. Hockley, President Bluestone and Hockley Real Estate Services,

Executive Director, SVN | Bluestone and Hockley

A reflection on being a landlord in the Portland Metro area during the pandemic.

As I am sure you have heard, the national unemployment numbers are dismal, with current rates (April 2020) estimated around 15%. This may be lower than the real number due to the challenges many newly unemployed have had filing and the processing backlog faced by local unemployment offices.

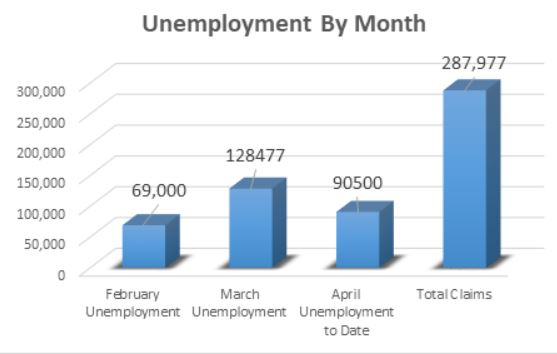

Below is a chart of the number of claims, by month, in Oregon. (April is through 4/18.)

The unemployment rates below are estimates based on initial claims filed and closely track national numbers.

- February: 3.2%

- March: 9.42%

- April: 13.73%

Collections

Our March Collections were normal, even as the pandemic rolled into Oregon. We transitioned our operations from the Barbur Blvd. office to our home offices in the third week of March. Thankfully, we spent the last two years investing in the infrastructure to be able to operate from the cloud.

Currently, Rents are being collected, and bills are being paid and maintenance operations continued. Many of our clients are being communicated with on a weekly basis or as the situation on the ground with their property changes.

April collections, so far, have been lower, with about 85+% of client revenues received across all property types as compared to an average of 95% in a normal month.

May residential rental collections will be impacted by the number of unemployed tenants, federal funds deployed, unemployment collected and the eviction moratoriums enacted by the cities of Hillsboro, Beaverton, Portland; Multnomah County; and the State of Oregon.

Residential Collections:

Bluestone & Hockley Collections Report

- 94.2%: April Rent Collected so far

- 93.4%: Units paid so far

- 5.7% Units requesting a payment plan

Residential Eviction Moratorium

Multnomah County allows tenants up to six months, after the county’s emergency declaration is lifted, to repay missed rent. (This grace period required tenants to demonstrate a COVID-related impact BEFORE missed rent was due.) As of April 16th, the Eviction Moratorium Six-Month Repayment Grace Period was revised to state that “any residential tenant shall have a six-month repayment grace period which includes rent and other service charges.

In April, Bluestone and Hockley negotiated payment plans with tenants, based on the then current language. These rules and regulations have become more restrictive. Based on the current language of the Multnomah County ordinances, payment plan agreements are still a valid strategy to use, by keeping a current record of understanding and legally nudging tenants to pay the most they are able (a partial payment for example).

Payment agreements currently have limited practical utility in Multnomah County, because, a) The language of the moratorium creates a repayment obligation that doesn’t begin until the emergency status is lifted, and we don’t know when that will be (i.e., we don’t yet have a “start date” for the 6-month repayment period) and b) Even more significantly, the language does not require any interim rent payments and merely states that tenants have 6 months to repay the covered debt once the emergency is lifted. Accordingly, once the emergency is lifted, the tenant can pay $0 of the arrearage until day 180 and we can’t terminate them for it until day 181.

Currently, the rest of the state is covered by either local regulations (i.e. Beaverton, Hillsboro, etc.) or by the Governor’s Executive Order 20-13.

See link here: https://www.oregon.gov/gov/admin/Pages/eo_20-13.aspx

Summary: Oregon Governor’s Executive Order 20-13 for residential tenancies:

During this moratorium, landlords of residential properties in Oregon shall not, for reason of nonpayment as defined in paragraph l(b) of this Executive Order, terminate any tenant’s rental agreement; take any action, judicial or otherwise, relating to residential evictions pursuant to or arising under ORS 105.105 through 105.168, including, without limitation, filing, serving, delivering or acting on any notice, order or writ of termination or the equivalent; or otherwise interfere in any way with such tenant’s right to possession of the tenant’s dwelling unit.

Nothing in paragraph 1 of this Executive Order relieves a residential tenant’s obligation to pay rent, utility charges, or any other service charges or fees, except for late charges or other penalties arising from nonpayment which are specifically waived by and during this moratorium. Additionally, paragraph 1 of this Executive Order does not apply to the termination of residential rental agreements for causes other than nonpayment.

During this moratorium, any residential or non-residential tenant who is or will be unable to pay the full rent when due under a rental agreement or lease, shall notify the landlord as soon as reasonably possible; and shall make partial rent payments to the extent the tenant is financially able to do so.

Commercial Eviction Moratorium

What is clear is that businesses that are unable to operate as a direct result of COVID -19 cannot currently be forced to pay rent or be evicted. At the same time, the Governor’s order expects commercial tenants that are able to need to pay rent. This implies that the use of PPP (Payroll Protection Program) or other funds to pay rent is expected, and we are seeing commercial tenants pay their rent if they were fortunate enough to have secured the loans.

Oregon Governor’s Executive Order 20-13 for commercial tenancies:

During this moratorium, landlords of non-residential properties in Oregon shall not, for reason of nonpayment as defined in paragraph 2(b) of this Executive Order, terminate any tenant’s lease; take any action, judicial or otherwise, relating to non-residential evictions pursuant to or arising under ORS 105.105 through 105.168, including, without limitation, filing, serving, delivering or acting on any notice, order or writ of termination or the equivalent; or otherwise interfere with such tenant’s right to possession of the leased premises.

This Order shall apply if a tenant provides the landlord, within 30 calendar days of unpaid rent being due, with documentation or other evidence that nonpayment is caused by, in whole or in part, directly or indirectly, the COVID-19 pandemic. Acceptable documentation or other evidence includes, without limitation, proof of loss of income due to any governmental restrictions imposed to mitigate the spread of COVID-19.

Nothing in paragraph 2 of this Executive Order relieves a nonresidential tenant’s obligation to pay rent, utility charges, or any other service charges or fees, except for late charges or other penalties arising from nonpayment which are specifically waived by and during this moratorium. During this moratorium, a non-residential tenant who is or will be unable to pay the full rent when due under a rental agreement or lease shall notify the landlord as soon as reasonably possible; and shall make partial rent payments to the extent the tenant is financially able to do so.

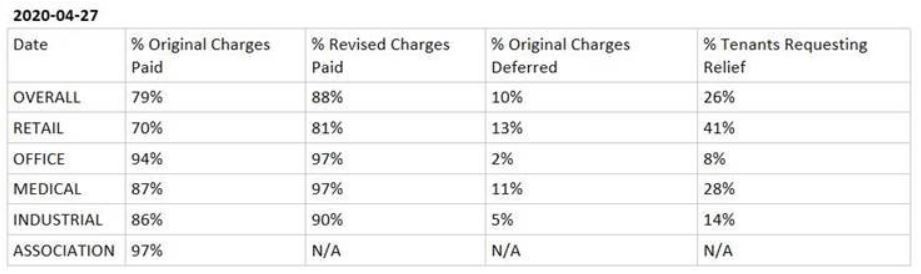

As you review our commercial rent collection charts below, you will see that our property managers worked very closely with our clients and tenants to collect 88% of April’s commercial rent.

Forbearance

Most of our property owners have had enough reserves to get through the month of April. Those in trouble have started negotiating with their banks to buy some breathing room.

- Some financial institutions are agreeing to put off payments for a couple of months, some are putting off principal payments and asking for interest-only. There are no consistent lender policies at this point. Freddie Mac will offer forbearance up to 90 days (three consecutive monthly payments). If the Borrower accepts this arrangement, Freddie Mac will also waive any associated late charges and default interest.

This is different than foreclosure, where a financial institution will take a property back from a property owner, through strict foreclosure or deed in lieu of foreclosure.

Association Collections

As of the 13th of April, approximately 86% of our Association homeowners had paid their assessments, compared to approximately 93% in a normal month. We expect that the month of May will result in a lower collection percentage as some owners were laid off.

- % of accounts paid: 85.94%

- % of accounts delinquent: 14.06 (of that 5.3% are in collections)

- April Late Fee Waivers: 4

Summary

Yes, COVID-19 does exist. We are aware of tenants that are infected with COVID who live in buildings we manage. We also have tenants who are taking care of sick family members, and many tenants who have been laid off or permanently lost their jobs as a direct result of this pandemic. Businesses have either closed or severely reduced the scope of their operations to comply with the Governor’s executive orders. The impact of this disease and the efforts to flatten the curve will be felt for many months.

There is a glimmer of hope on the horizon with the May 1st opening of hospitals and dental offices for minor procedures. (Of course, this is dependent on the ability to obtain personal protective equipment (PPE). The Governor’s order requires a two-week supply before work can begin.) If this is successful, we should see the opening of the state as soon as the Governor thinks it is safe.

We are on the edge of a new frontier and need to adjust our expectations. Investors are resourceful and will find a way to cope with all these changes. The only way property owners will obtain all of their rent payments will be full employment. We will all have to work as a community to open the state in a safe manner and get everyone back to work, with the appropriate social distancing and PPE. There is still danger in the promised land.

CARES Act Summary From NAA 4.13.2020 (2)

Mult Co 4.16.2020 Ordinance No. 1284

Mult Co 3.29.2020 Ordinance 1282

Hillsboro 3.25.2020 Administrative Order 2020-01