2021 Portland Tax Changes

Shortly after the November 3, 2020 elections, SVN | Bluestone and Hockley, Bluestone and Hockley Real Estate Services, Moss Adams (certified public accountants) and CKR Law Group (specializing in tax appeals) co-sponsored a seminar on new taxes that businesses, high net worth individuals and real estate investors will incur in 2021.

The recent election propelled Multnomah County and especially the City of Portland to one of the most expensive tax jurisdictions in the nation, making it significantly more challenging for high-net-worth investors to live here and invest in real estate.

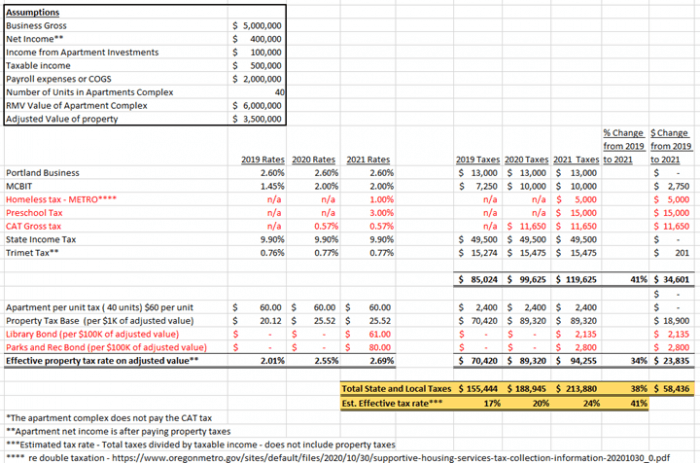

This article will review the existing and newly created taxes and bond measures, as well as provide examples for a better understanding of the impact of these changes. (The chart below was provided by Moss Adams, CPA.)

To better understand this chart, more detailed information has been compiled HERE and can be found below.

Examples:

Example 1- A couple has a distribution business that grosses $5,000,000 a year with $2M in payroll and net’s $400,000 a year in Multnomah County before taxes. They also own a 40-unit apartment property located in the City of Portland which grosses less than $1M, is not part of unitary group and generates net income of $100,000 a year*. Their taxable income is $500,000 a year.

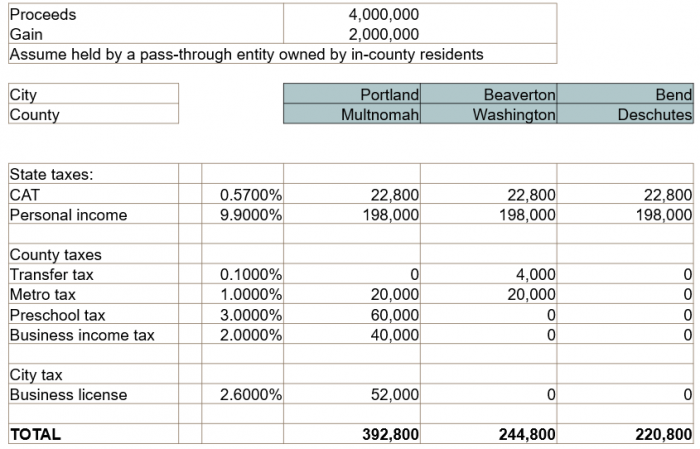

Example 2- This three-county comparison regarding the sale of an investment property gives a very clear view of the most highly taxed counties in 2021.

Summary

This news is challenging for real estate investors, especially since commercial and residential rents have been buffeted and, in some cases, lost to national and regional COVID restrictions. In addition to the COVID restrictions, many residential real estate investors are faced with rent control limitations that are coming into play for their second year in 2020.

Clearly the Portland Metro area and the state of Oregon have seen a significant increase in income and property taxes over the last two years. These taxes will significantly affect high- net worth individuals. All property owners are encouraged to review their tax situations with their tax advisors before the beginning of 2021 and discuss their future investment strategies with their SVN | Bluestone and Hockley commercial real estate advisor.

Detailed Tax Information

Local taxes

- Portland Business License Tax entities 2.6% of Net Income – This tax applies to businesses grossing over $50,000 a year. In other words, if you collect over $50,000 a year in rental receipts, you owe taxes to the City of Portland.

- As compared to Beaverton Business License fees of:

- Multnomah County Business Income Tax Business entities (MCBIT) increased to 2.0% during 2020. This tax applies to businesses grossing over $50,000 a year. In other words, if you are a real estate investor and collect over $50,000 a year in rental receipts, you owe taxes to the Multnomah County.

- Washington County has no income tax, instead it has a real estate transfer tax. One percent of the sales price is imposed on each transfer of real property located in Washington County, Oregon.

- Portland Metro Supportive Services tax aka (Homeless tax) (effective Jan 21) – This is a Metro region-wide tax that is meant to help create funds to fight the homelessness challenges. The program is funded by a 1% tax on taxable income of more than $125,000 for individuals and $200,000 for couples filing jointly, and a 1% tax on profits from businesses with gross receipts of more than $5 million.

- Tri-Met Transit Tax (Portland Metro area) Payroll Tax – Self-employment Income as well as wages are taxed 0.7737%. This tax commenced 2018.

- Multnomah County: Tuition-free preschool (Measure 26-214 is effective Jan 2021) – The “preschool for all” initiative will be funded by an income tax on higher-income earners: individuals with an income over $125,000 will be taxed at 1.5%, and another 1.5% on county residents who earn more than $250,000 for a total of 3%. That rate could rise another 0.8% to 2.3% in each category, in 2026, depending on the needs of the program, which the county expects to be serving 7,000 new students by that time.

- City of Portland rental tax – $60/Unit, which is similar to a tax charged by Gresham to inspect units for habitability.

- Library Bond (Measure 26-211) – This measure funds the expansion of Multnomah County library space, which will be increasing by 50% through expansions of seven library branches and the development of a new East County flagship library in Gresham. The bond measure will raise $387 million and cost property owners an average of $0.61 cents per $1,000 in assessed property value for eight years. For a property that is valued at $2,000,000, property owners will pay an additional $1,220 on their property taxes in 2021.

- Parks and Recreation Bond (Measure 26-213) – This levy will prevent ongoing reductions to park services and recreation programs, preserve and restore park and natural area health, and center equity and affordable access for all. The levy is $0.80 per $1,000 assessed value. For a property that is valued at $2,000,000, property owners will pay an additional $1,600 on their property taxes in 2021.

- Portland Schools Bond (Measure 26-215) – This bond measure provides $1.2 Billion in funding for facilities and educational investments. The measure is not expected to increase tax rates above previous targets, because existing debt service is scheduled to decline.

Oregon Taxes

- Corporate income tax (C corporations) – The corporate excise tax applies to corporations based in Oregon and is assessed on gross income from business conducted within the state. As of 2020, this tax has two marginal rates: 6.6% on the first $10 million of income and 7.6% on all income above $10 million.

- All S corporations doing business in Oregon are required to pay a minimum excise tax of $150.

- Partnerships that are required to file Oregon tax returns, including LLCs classified as partnerships for federal tax purposes, are required to pay a minimum excise tax of $150. This includes partnerships that have income from Oregon and have one or more partners who are Oregon residents.

- Corporate Activity Tax Modified Receipts – The CAT is applied to taxable Oregon commercial activity in excess of $1 million (Gross receipts – some subtraction for Cost of Goods sold). The tax is computed as $250 plus 0.57 percent of taxable Oregon commercial activity of more than $1 million. Only taxpayers with more than $1 million of taxable Oregon commercial activity will have a payment obligation. If you collect or make over $1,000,000 in annual rental income from your real estate investments, expect to have to pay this tax.

- Personal income tax – This is paid by individuals on their taxable income at 9.9%

- Transit Tax (statewide tax) – The statewide transit tax is calculated based on the employee’s wages as defined in ORS 316.162. Employees who aren’t subject to regular income tax withholding due to high exemptions, wages below the threshold for income tax withholding, or other factors are subject to statewide transit tax withholding. On July 1, 2018, employers began withholding the tax (one-tenth of 1 percent or .001) from:

- Wages of Oregon residents (regardless of where the work is performed).

- Wages of nonresidents who perform services in Oregon.

- Oregon unemployment tax for employers and employees (SUTA) – Effective January 1, 2021, Oregon businesses will pay more in payroll taxes to the state unemployment trust fund in 2021. However, the change to Schedule 4 by the Employment Department is a modest shift from 2020. The average rate is estimated at 2.26% on the first $43,800 paid to each employee.