Industrial Market Report: 2019

Overview

The fundamental drivers in this growing regional industrial market remain strong, despite recent performance moderation. While vacancies are significantly below the historical average, a large influx of speculative deliveries contributes to some volatility. This trend will likely continue. Of the 1.5 million SF of speculative space under construction, about 60% is available for lease. Rent gains have moderated, after years of robust growth, but remain above the historical average. Rent growth also remains stronger for the industrial sector than for Portland’s office, retail, or multifamily sectors.

In July 2019, Intel broke ground on a 1.5-million-SF expansion to D1X at Ronler Acres. In 18Q3, Amazon delivered two distribution centers to the metro, totaling almost 2 million SF. Other companies that continue to expand their presence in Portland include third-party logistics firms, retailers/wholesalers, and suppliers to the local market.

Investment over the past 12 months is well above Portland’s historical average, and market cap rates are dependably near 6%. Favorable demographics, increasing housing construction, a structurally low vacancy rate, and exposure to trade by way of a moderately sized port can all be found here for a reasonable cost.

Rent

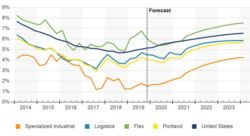

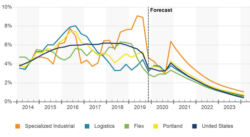

Quarterly industrial rent growth has oscillated between 4.5% and 5.5% since mid-2017. Rent growth for industrial space remains substantially higher than growth for the office, retail, or multifamily sectors. With many newer speculative developments lingering on the market, along with a heavily speculative pipeline, rent gains may moderate.

Once the best-performing Industrial property type, rent growth for logistics space has compressed in the past three years. After peaking at about 8% in 16Q3, annual growth in now below 5%. As logistics space comprises nearly 70% of Portland’s industrial inventory, performance for this slice has driven the overall slowdown in rent growth.