Is Multifamily Overbuilding? – ALN Apartment Data, Inc.

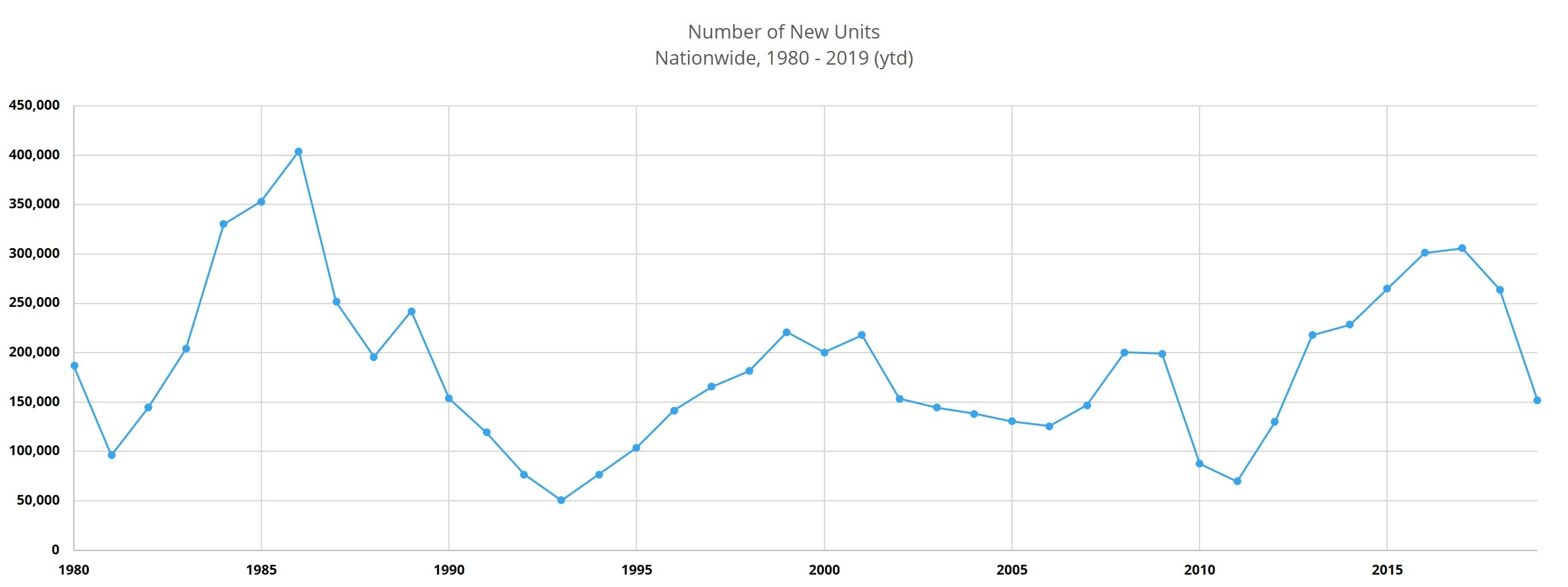

This decade, more than 2 million new multifamily units have been added across the US. In terms of raw numbers, this volume hasn’t been seen since the 2.4 million new units introduced in the 1980s. However, if we consider annual new units as a percent of existing capacity, the annual average of 2% for this decade falls well short of the 5% average from the 1980s.

What has been the effect of this new supply? Are we approaching an overbuild threshold? To examine these questions and others, we will look at vacancies within conventional properties with at least 50 units. We will look at the current new construction pipeline and its implications given recent net absorption* performance. Rather than just dealing with nationwide numbers, specific markets will be looked at.

View the full monthly Markets Stats PDF

Vacancies

Before considering the new construction pipeline, it’s relevant to check in on how recently delivered new supply has fared. As recently as 15 months ago, only two markets had more than 10,000 vacant lease-up units. As of the end of July 2019, there are five. Of the 99 ALN markets with units currently in lease-up, the average market has about 3,300 vacant lease-up units.

The Los Angeles market has about 21,500 vacancies in lease-up properties, which about 5% of its existing capacity. The Dallas – Fort Worth market also has a little more than 21,000 vacant lease-up units, almost 3% of existing capacity. Other markets that stand out include New York City, Denver, and Chicago – each with around 15,000 vacant lease-up units.

Vacancies are not necessarily a bad thing, lease-ups are not instantaneous. For an area like Dallas – Fort Worth, with an average of 18,000 units absorbed annually over the last three year-over-year periods, 21,000 vacant lease-up units isn’t a terrible number. For a market like Chicago, 15,000 lease-up vacancies represent more than two years of average absorption.

Los Angeles, with 21,000 lease-up vacancies is similarly situated with an average annual absorption of 10,000 units over the last three 12-month periods. These numbers reflect the backlog of new units, they don’t account for supply still on its way.

To read the full article, click HERE

Written by: Jordan Brooks | August 13, 2019